What is the VITA Program?

VITA is an IRS sponsored, free tax preparation program that is offered to low to moderate income, elderly and disabled members of the community who are not able to afford professional tax filing services. All tax preparers are trained in tax law and are required to be certified by the IRS to prepare tax returns as volunteers.VITA/TCE Certifications

Instructions

To complete the certification process, you will need the following publications for reference purposes

Please note the following- These are open book exams.

- The exams are not timed – unlimited time to complete.

- You must get 80% of the questions correct to pass each exam.

- You get two (2) attempts to complete each exam.

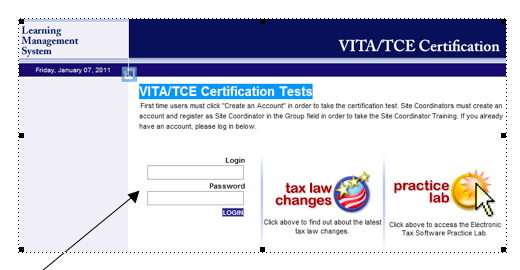

- 1) Go to the VITA/TCE Central website, also known as Link & Learn at https://www.linklearncertification.com/d/

- Once on the VITA/TCE Central, click on “Create Account”.

- Complete the “Self-Registration” screen.

- For “Group” choose “01 – VITA Volunteer”.

- For “Training Source:” choose “Link and Learn Taxes (e-learning).

- Then click “Register” and then “Continue”.

- Save your password for accessing this site. You will need to access the site on the first day of work in VITA.

- Complete the “2016 Volunteer Standards of Conduct Training”. Click on the link and hit “Launch”.

- Complete the “2016 Volunteer Standards of Conduct – Exam”

- Complete the “2016 Intake/Interview and Quality Review Training”

- To review the Link and Learn e-Training, go to apps.irs.gov/app/vita/

- Click on the “Certification Paths” tab.

- Then click “Basic” and choose “Student” for the “Are you a student or a teacher?” question.

- Then click “Start Basic Course – Student” to review the information that is covered in the Basic Exam.

- You should read through the tutorial lessons in the order provided. You can make notes if you so choose but you can always go back to the tutorial if you get stuck on a question.

After completing the tutorial, attempt the questions in Publication 6744 – Volunteer Assistor’s Test/Retest. http://www.irs.gov/pub/irs-pdf/f6744.pdf These are the type of questions you must be familiar with to pass the tests.- At the bottom of the Basic Course Menu, click on “Test (includes Standards of Conduct)” under “Certification Tests”

- Click “Leave IRS Site” to return to the VITA/TCE Central website and take the “2016 Basic Exam”

- Complete steps 6 through 13 for the Advanced.

- Click on “Advanced” under “Certification Paths” in the IRS website to do the training.

- Click on the “Advanced” tab on VITA/TCE Central to take the exam.

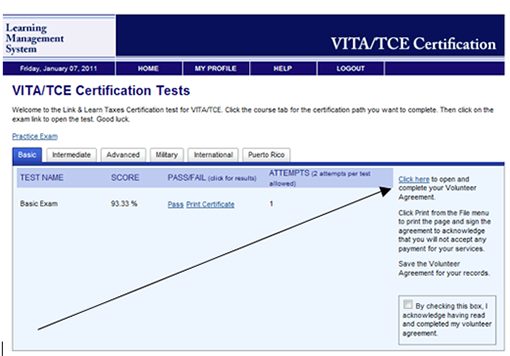

- After completing the Advanced Exam, please upload a copy of your Volunteer Agreement Form, not the certificates, to blackboard in the “Assignments” area. Follow the directions below to access the volunteer agreement.

Steps for Accessing Volunteer Agreement

Instructions

- GO TO THE LINK AND LEARN VITA/TCE CERTIFICATION TESTS WEBSITE:

- VOLUNTEER MUST LOG IN USING THEIR PERSONAL LOGIN AND PASSWORD

- ONCE LOGGED IN, THE VARIOUS EXAM TABS CAN NOW BE ACCESSED

- CLICK ON THE “CLICK HERE” LINK ON THE RIGHT SIDE OF THE PAGE TO OPEN THE VOLUNTEER AGREEMENT.

- ONCE OPENED , THE VOLUNTEER AGREEMENT CAN BE PRINTED OR SAVED AS A PDF.